B2B, Onboarding 6 min read

What is KYB onboarding? How to balance speed and security in business verification

Fraud tactics in financial services are evolving at an unprecedented pace. From AI-generated documents to deepfakes, fraudsters are deploying increasingly sophisticated tools to evade detection. Among the most alarming trends is the rise of synthetic identity fraud—where stolen and fabricated data are combined to create fake but convincing business entities. Once considered niche, this threat now carries a massive price tag: global estimates suggest it costs financial institutions between $20 and $40 billion each year.

These developments are pushing traditional KYB (Know Your Business) processes to their breaking point. Often reliant on manual reviews, fragmented data sources, and rigid workflows, legacy KYB approaches can no longer keep pace with modern fraud. And while comprehensive verification is still critical, too much friction at onboarding risks deterring legitimate customers—undermining growth just as much as unchecked fraud does.

But KYB doesn’t have to be a tradeoff between risk and revenue. In this article, we explore the modern KYB process—one that leverages automation, integrates rich third-party data, and strikes the right balance between compliance and customer experience. Done well, KYB becomes more than a regulatory hurdle; it becomes a foundation for faster onboarding, stronger fraud prevention, and sustainable growth.

Key takeaways

- KYB onboarding is essential for verifying business legitimacy, uncovering ownership structures, and ensuring compliance before entering financial relationships.

- Traditional KYB processes are too slow and fragmented, often relying on manual reviews that create friction, high costs, and blind spots for fraud.

- Modern KYB leverages automation and third-party data, enabling faster onboarding, smarter risk assessments, and reduced drop-off rates.

- A risk-based approach accelerates low-risk businesses while applying Enhanced Due Diligence (EDD) only to high-risk entities, balancing speed with security.

- Continuous monitoring is critical, as fraud risks often emerge after onboarding through ownership changes, synthetic identities, or suspicious transactions.

- Future-ready KYB platforms integrate fraud prevention, AI copilots, and no-code tools, empowering teams to adapt quickly while staying compliant at scale.

What is Know Your Business (KYB) onboarding?

KYB onboarding is the process of verifying that a business entity is legitimate, low-risk, and compliant before entering a financial relationship. It’s the corporate equivalent of KYC (Know Your Customer) but with additional layers of complexity—such as uncovering ownership structures, validating business registration, and assessing risk based on industry, geography, and behavior.

A robust Know Your Business (KYB) process serves as the first line of defense against fraud, money laundering, and other financial crimes. It’s also increasingly central to how risk and compliance teams manage exposure in real-time, especially as fintechs expand into new markets or onboard customers at scale.

Why KYB verification matters

KYB isn’t just a regulatory checkbox—it’s a cornerstone of long-term resilience in financial services. As global AML (Anti-Money Laundering) and CTF (Counter-Terrorist Financing) frameworks grow more complex and jurisdiction-specific, regulatory expectations are rising across the board. At the same time, fraudsters are finding new ways to exploit corporate structures, using shell companies, nominee directors, and opaque ownership hierarchies to obscure their activities.

Effective KYB processes help institutions surface these risks early. By verifying business identities and understanding ownership structures, teams can apply a risk-based approach to onboarding—accelerating low-risk cases while flagging those that require deeper scrutiny.

While it may seem that thorough verification slows down growth, the opposite is often true. A well-designed KYB onboarding process enables faster, safer expansion by quickly clearing legitimate businesses and dedicating resources only where enhanced due diligence is truly needed. In this way, strong verification becomes not a blocker but a catalyst for sustainable growth.

Who needs to implement KYB processes?

KYB onboarding is essential for any organization that does business with corporate clients. While it’s most commonly associated with banks and credit unions, it’s equally critical across the broader financial ecosystem:

- Fintech platforms that offer digital lending, payments, or embedded finance must strike a balance between rapid growth and compliance and fraud prevention.

- Insurance companies and money service businesses are subject to stringent industry-specific verification requirements.

- Legal and professional services firms must verify their clients to prevent financial crime.

- Large enterprises with global supply chains must validate their business partners to mitigate risks related to fraud, regulations, and reputation.

In short, if you onboard or transact with businesses, KYB isn’t optional—it’s the foundation of how you begin a relationship with them.

The challenges of traditional KYB

Despite its importance, many institutions still rely on legacy systems and manual reviews for business verification. This leads to:

- Long onboarding timelines, resulting in drop-offs and lost revenue

- High operational costs due to repetitive manual tasks

- Disjointed data systems, which obscure key risk signals

- Inflexibility, especially when navigating new markets or changing regulations

With regulations evolving rapidly—and often differently across geographies—staying compliant requires a KYB system that’s not only accurate but also adaptable.

6 essential steps of the modern KYB process

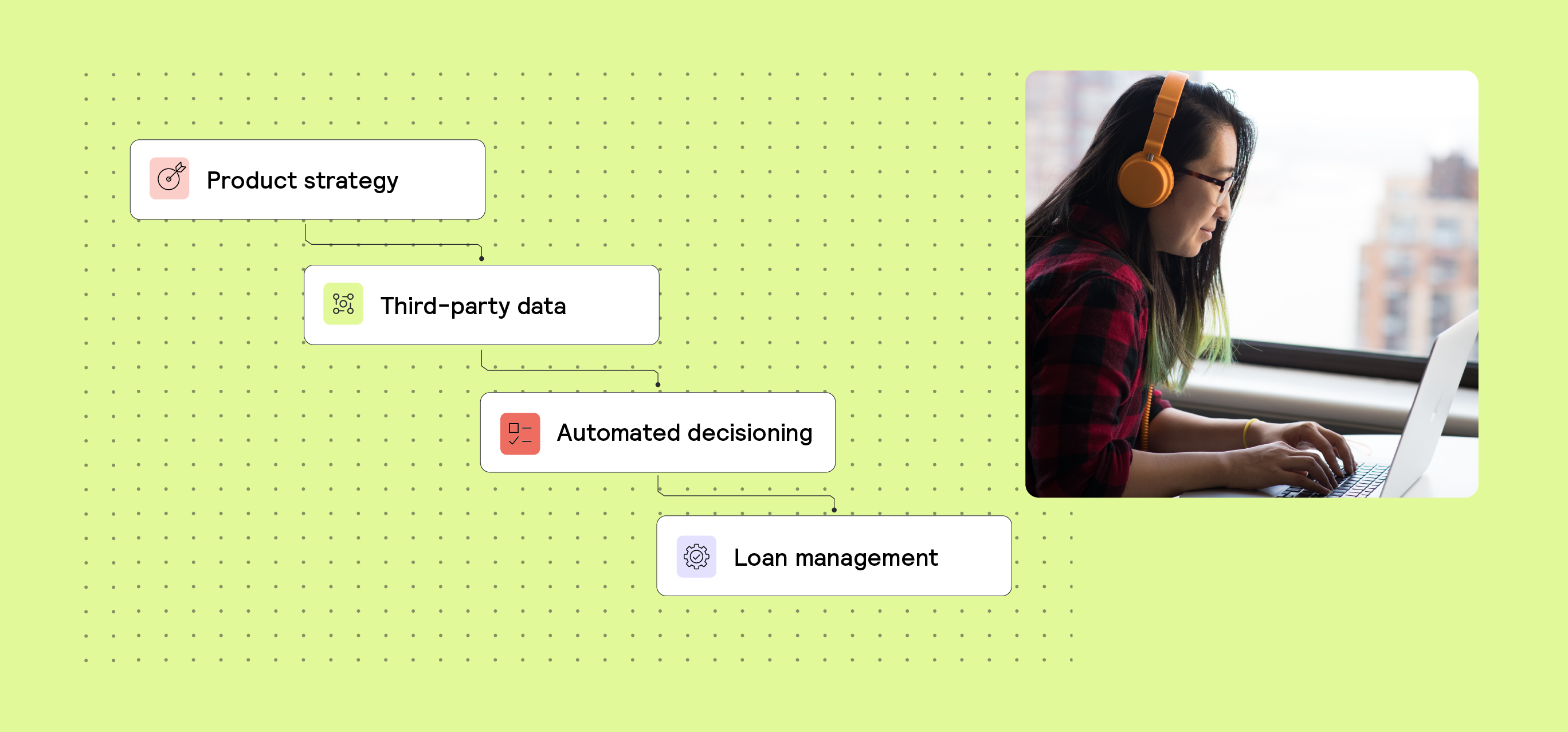

Legacy KYB verification methods can be complex, manual, and hard to scale. Below is a modern, data-driven KYB framework that fraud, risk, and compliance teams use to strike a balance between thoroughness and operational efficiency.

1. Collecting basic business information

Adequate KYB checks begin with gathering essential company details such as business name, tax identification numbers, and operational information. This initial information provides the starting point for further verification and risk assessment. Modern KYB platforms can automate much of this data collection, reducing manual effort and improving accuracy.

2. Verifying ownership and control

Understanding who ultimately owns or controls the business is critical. This involves identifying Ultimate Beneficial Owners (UBOs), mapping ownership hierarchies, and conducting Know Your Customer (KYC) checks on controlling individuals.

This step aims to reveal complex ownership arrangements that may indicate attempts to conceal the true beneficiaries. AI-powered tools can help detect unusual patterns in organizational structures that might warrant further investigation.

3. Conducting risk assessment

A comprehensive KYB process includes a multi-dimensional risk analysis. This typically incorporates:

- Geographic risk, based on the jurisdiction of incorporation and operation.

- Industry risk, tied to exposure to regulated sectors or cash-heavy businesses.

- Behavioral risk, inferred from expected transaction patterns or service usage.

Modern teams rely on decision platforms that harness data analytics to generate nuanced risk scores—factoring in everything from geography to industry and behavioral signals. This enables smarter, risk-based decisions that focus resources where they’re needed most.

A key consideration with kYB onboarding is the tradeoff between accuracy and drop-off rates. Introducing steps in the onboarding process may increase the accuracy of a decision, but it can also introduce friction for customers and result in them dropping out of the process. So, it is important to create a strategy that balances these concerns for your customer segment.

For example, leading lenders often start with passive onboarding checks (such as obtaining ID risk scores and determining a cut-off value). If this approach does not reduce fraud to an acceptable level, they might introduce an active check, such as requiring a one-time password that can prove a customer is who they say they are.

4. Enhanced Due Diligence (EDD)

For higher-risk entities, institutions apply more rigorous scrutiny—such as verifying the source of funds, screening for adverse media, and checking sanctions or PEP (politically exposed person) lists.

EDD is resource-intensive but crucial for high-risk clients. Automating parts of this process with AI-driven tools can make it more manageable while maintaining thoroughness and accuracy.

5. Ongoing monitoring

KYB checks aren't a one-time event—they require continuous attention through periodic reviews, transaction monitoring, and tracking of business changes, such as ownership transfers. Automated monitoring systems can detect changes in risk profiles or suspicious patterns in near real-time, allowing for proactive risk management.

6. Data management and record-keeping

Maintaining clear audit trails is essential for proving compliance and supporting internal investigations. This includes:

- Logging all decision steps and data used

- Storing records in a secure, tamper-proof system

- Retaining data based on jurisdictional requirements

The importance of automation in KYB: Consistency, security, and scalability

Automating Know Your Business (KYB) onboarding has evolved from a nice-to-have to a foundational capability for scaling efficiently. Where manual, fragmented workflows once slowed growth and introduced risk, modern automation now enables faster onboarding, lower operational costs, and a better customer experience.

One of the greatest strengths of automation is consistency. Applying uniform verification standards across all applications reduces human error and eliminates bias—which is essential for maintaining fairness and compliance at scale. Automated systems can also process a broader range of risk indicators, from behavioral patterns to real-time data feeds, improving an institution’s ability to detect sophisticated fraud attempts that manual reviews might miss.

Security and regulatory compliance are equally strengthened through automation. An effective KYB platform should offer encrypted data storage, granular access controls, full audit trails, and built-in regulatory logic to stay current with changing requirements—all while easing the burden on compliance teams.

Finally, automation unlocks true scalability. Instead of growing operational headcount in tandem with onboarding volumes, institutions can maintain efficiency by streamlining routine checks and escalating only the highest-risk cases for manual review. Increasingly, forward-thinking teams are incorporating artificial intelligence to further optimize Know Your Business (KYB) processes—utilizing AI Copilots to develop and refine decision logic, machine learning models to identify fraud patterns, and natural language processing to enhance document verification.

Integrating KYB with fraud prevention

However, even the most sophisticated KYB process is only the beginning. Fraud risks often emerge after onboarding—through front companies, synthetic identities, and business email compromise tactics that reveal themselves over time.

That's why leading organizations are moving toward a unified approach, tightly integrating Know Your Business (KYB) onboarding with continuous fraud monitoring. Instead of treating verification and fraud detection as isolated functions, they leverage real-time identity and behavioral analytics, pattern recognition, and device intelligence across the full customer lifecycle. This broader, dynamic view of business risk not only improves fraud resilience but also strengthens overall decision-making as businesses grow and evolve.

Choosing the right system for your KYB and fraud prevention strategy

When evaluating KYB and fraud prevention platforms, it’s essential to prioritize flexibility, the depth of integrations, and the ability to adapt to emerging threats quickly. A robust system should provide instant access to critical data sources, such as credit bureaus, business registries across multiple jurisdictions, identity verification services, and global watchlists, thereby eliminating complex integrations and enabling comprehensive checks from the outset.

Just as important is the ability to optimize continuously. Features such as A/B testing of verification workflows, simulation tools to predict the impact of changes, and real-time analytics dashboards transform verification into a dynamic, evolving capability rather than a static compliance requirement.

Key capabilities to look for include in a KYB/fraud prevention platform:

- Low-code/no-code capabilities that empower non-technical team members to build, test, and adapt KYB and fraud prevention strategies instantly without relying on engineers.

- AI Copilot features that suggest improvements, debug issues, and explain KYB workflows in plain language.

- Prebuilt integrations to registries, bureaus, identity providers, and watchlists.

- Real-time experimentation, simulation, and KPI monitoring tools to optimize workflows over time.

In today’s environment—defined by rising fraud, tighter regulation, and the constant need to operate more efficiently—KYB can no longer be treated as a back-office task. Done right, it becomes a strategic lever: enhancing fraud resilience, supporting growth, and driving smarter, faster risk management.

Ready to unlock fast scalable KYB?

Frequently Asked Questions (FAQs)

Q: What is KYB onboarding in financial services?

A: Know Your Business (KYB) is the legal process which fintechs and banks must satisfy to accept a new customer into their business, such as opening a bank account or issuing a loan. The overall onboarding process consists of many steps, and KYB checks are part of this process.

Q: Why is balancing speed and security important in KYB verification?

A: Traditional KYB processes often slow down the onboarding process, leading to customer drop-offs. At the same time, skipping verification exposes institutions to fraud and compliance risk. Risk-based KYB decisions can help strike the balance: fast-tracking low-risk businesses while applying enhanced due diligence to high-risk cases.

Q: What role does AI play in modern KYB processes?

A: AI-powered KYB onboarding can enhance fraud detection by spotting patterns in ownership structures, synthetic identities, and behavioral risk signals. Talk to our team about modernizing your KYB process.