As the finance industry continues to advance, it has never been easier to launch a lending product from scratch. Instead of spending significant time and money building the components of a lending product, fintechs and banks can now leverage existing software providers to create new offerings quickly and affordably.

Often it can be hard to know where to start when setting up a modern lending product. To help you begin, we have summarized industry best practices to provide an overview of the key steps required.

Key takeaways

- Define your product strategy upfront by selecting an underserved customer segment, tailoring financial products to their needs, and ensuring compliance with all relevant regulations.

- Partner with the right third-party data providers to power both onboarding and credit decision-making, balancing coverage, accuracy, and compliance requirements to reduce risk while improving customer experience.

- Leverage an automated decision engine to streamline onboarding and risk assessments, enabling faster, more accurate, and continuously optimized lending decisions with minimal engineering effort.

- Implement a Loan Management System (LMS) and secure funding to originate, service, and scale loans effectively, while aligning early with partner banks to accelerate launch and avoid compliance bottlenecks.

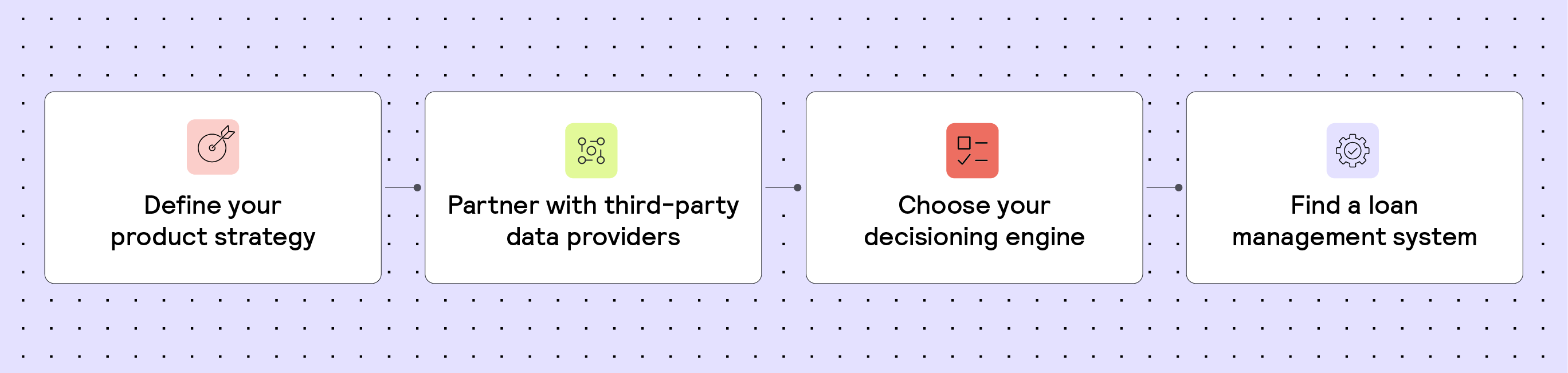

Key steps to set up a new lending product

1. Define your product strategy

Position your product

As a first step, you need to identify your target customers. To find their niche, companies typically choose a customer segment that is underserved by the market (for example, SMEs or freelancers with irregular income). Once you have defined your customer segment, identify your segment's financial needs so that you can tailor your lending product to them.

Understand the regulatory requirements

Next, research the regulatory requirements associated with your chosen segment. Depending on the type of product offering, you may need to partner with a licensed bank to give out loans to customers or ensure compliance with specific financial regulations. For example, if you are lending to an active member of the US military, Federal law requires special protections, like capping interest rates on some loan products.

2. Partner with third-party data providers

Find the right data sources

Data is vital to making accurate, informed decisions. It enables you to acquire borrowers at the lowest possible cost (and risk) and provide customers with highly personalized loan offers. So it is important to identify what data you need to make lending decisions and determine how you will access that data.

There are two key places in the lending process to consider: customer onboarding and credit decisions.

Customer onboarding data

In the case of customer onboarding, most countries have Know-Your-Customer (KYC) and Anti-Money Laundering (AML) regulations that require lenders to verify customer identities to prevent fraud and ensure they are legally allowed to do business with them. It is important to identify the regulations you must adhere to for your customer segment and choose the best vendor to supply that information.

When choosing a KYC data vendor, lenders often have to make a trade-off between coverage and accuracy. TransUnion TruValidate, for example, provides insights on a large share of the US population, so it has wide coverage. In contrast, Experian Precise ID offers insights into a smaller population share, but their indicators are more accurate. Usually, the level of coverage vs. accuracy you need depends on the risk profile of your customer segment.

When it comes to obtaining AML data, lenders often consider vendors such as LexisNexis WorldCompliance and Bridger Insight. Both companies scan global databases for negative media, politically exposed people, sanctions lists, and country-specific regulations such as OFAC in the US. You should assess these to see which is most suited to your needs.

Credit data

In making credit decisions, the external data sources you need depend entirely on your customer segment. If you want to operate in a segment where customers have established credit histories, you can partner with a credit bureau or a related data aggregator, such as CRS. If your customer segment is less traditional, such as SMEs (who do not typically have established credit histories), you can also explore data providers who provide alternative insights. Codat, for example, helps lenders determine SME creditworthiness by providing access to SME financial data, such as accounting, banking, and e-commerce data.

Negotiate and undergo checks with data providers

Once you have identified the external data sources that will inform your credit decisions, you need to establish relationships with your chosen data providers.

Commercial negotiations

In most countries, there is room to negotiate contracts with data providers. Ask your provider if they can offer volume-based discounts, as CRS does.

Data provider checks

Partnering with data providers can take time and preparation. Depending on the provider, you may need to undergo checks that determine whether your business can access the data. Some credit bureaus, for example, require office inspections or technical acceptance tests. Choosing high-quality aggregators that manage compliance in-house can significantly speed up these processes, but make sure to account for these checks in your product launch plan.

3. Choose your automated decision engine

Get access to a scalable decision infrastructure

Decisions occur at multiple stages in the lending process – from KYC and AML checks (onboarding stage) to credit underwriting (credit decision stage). To make these decisions, lenders need decision engines that enable them to make accurate, automated decisions in real time.

Buying a decision engine from a software provider can help you launch your product quickly and save you significant resources compared to building one in-house.

Create automated decision flows

Customer onboarding

Lenders need an onboarding decision engine that decides whether or not to onboard a customer and move them through to the credit decision stage. The goal at this point in the process is to avoid accepting customers that may be fraudulent.

A key consideration with onboarding decisions is the tradeoff between accuracy and drop-off rates. Introducing steps in the onboarding process may increase the accuracy of a decision, but it can also introduce friction for customers and result in them dropping out of the process. So it is important to create the right decision flows that balance these concerns for your customer segment.

For example, leading lenders often start with passive onboarding checks (such as obtaining ID risk scores and determining a cut-off value). If this approach does not reduce fraud to an acceptable level, they might introduce an active check, such as requiring a one-time password that can prove a customer is who they say they are.

Credit decisions

Once a customer passes the onboarding stage, you must assess their creditworthiness and create an individualized loan offer. The rules, scorecards, and models that form the basis of this credit decision step are called a credit policy. Created by credit experts, a credit policy consists of three main elements:

- Knockout rules remove people from the process who clearly do not meet lending criteria. For example, those who are minors or unemployed. This prevents lenders from paying for third-party data on applicants that do not meet their general risk appetite.

- Creditworthiness checks determine how likely a potential borrower is to default. These assessments are based on rulesets, scorecards, or models that integrate the external data from your chosen providers (such as credit bureaus).

- Affordability calculations determine the maximum loan amount and interest rate a customer could afford to service (while still meeting their everyday financial obligations).

You can build and maintain these manually, but many lenders these days choose to use a credit decision engine that turns their credit policies into simple, adjustable decision flows that easily integrate all of their desired data sources. To do this, state-of-the-art new lenders leverage software providers like Taktile, which empower their credit teams to quickly build and adjust credit policies and continuously experiment with them to make highly optimized credit decisions.

“Taktile enables us to launch our first lending offering quickly and takes care of all the necessary data integrations to save us time and resources.”

Lenders can also go one step more and integrate machine learning models on Taktile to further reduce lending risk by identifying patterns in customer behavior.

4. Find a Loan Management System

Ensure you have capital to originate your loans

After you have made a credit decision, you need to originate the loan. First-time lenders tend to fund loans using their own capital. Once they collect enough evidence that their credit policy works as expected, lenders usually opt to obtain debt financing from third parties.

Manage your loans through their lifecycle

To originate, then manage and service their loans, most lenders use specific software solutions that provide them with a system of record – called a Loan Management System (LMS). You may want to explore leading LMS software providers like Canopy or Peach. These providers help you with everything from repayments and collections to customer reminders in case of late payments.

Finally, always align with your partner bank

In most cases, fintechs that start lending for the first time partner with a licensed bank. So it is helpful to align each component of a new lending product as early as possible with your partner bank. The more proactive you are in doing so, the less likely a bank's internal processes will inhibit you from launching your product quickly.

By following the steps outlined above, you should be well-positioned to launch a highly effective lending product in no time.

Disclaimer

This information provided in this article does not, and is not intended to constitute professional advice; instead, all information, content, and material are for general informational and educational purposes only. Accordingly, before taking any actions based upon such information, we encourage you to consult with the appropriate professionals.

Frequently Asked Questions (FAQs)

Q: What is the fastest way to launch a new lending product?

A: The quickest way to launch a new lending product is to combine a clear product strategy with pre-built software solutions. Instead of building infrastructure in-house, fintechs and banks can leverage decision engines, loan management systems, and third-party data integrations to get to market in weeks, not months.

Q: Which data sources are essential for new lending products?

A: Most lenders start with credit bureau data, but increasingly use open banking data, accounting data, and KYC/AML providers to improve risk assessment and expand approval rates. Choosing the right mix depends on your target customer segment.

Q: Why use an automated decision engine for lending?

A: Automated decision engines streamline onboarding and credit underwriting by integrating data, running real-time risk checks, and reducing manual reviews. With platforms like Taktile, teams can build, test, and optimize credit policies without engineering support.

Q: How do I ensure compliance when launching a lending product?

A: Compliance starts with KYC/AML checks, audit-ready decision logic, and alignment with partner banks. Using trusted third-party data providers and a decision platform with built-in compliance tracking helps lenders stay regulation-ready from day one.

Q: How can Taktile help me launch faster?

A: Taktile provides seamless data integrations, low-code decision flows, and automated credit policies, removing the guesswork from risk decisions. Request a demo of Taktile’s AI Decision Platform to see how you can launch and scale your lending product quickly.