Product, Portfolio Monitoring 3 min read

Taktile launches scheduled Jobs feature for frictionless portfolio monitoring

Automation can give you superpowers, with many teams using it today to prevent defaults, unlock new revenue opportunities, and achieve more sustainable long-term product growth. However, many still find it challenging to set up automated workflows and leverage them to their full potential without needing the help of engineers.

When it comes to making automated decisions in real-time, such as when a customer submits a loan application, an API request is required to initiate them. With the help of modern decision-making platforms like Taktile, teams can now build, run, and test real-time decisions without needing to build or maintain an API connection themselves. This allows teams to own the development and management of real-time decisions end-to-end without the help of engineers.

However, after customers are onboarded, it often becomes tougher for teams to use automation in the same way for activities like portfolio monitoring, where automated decisions are not triggered by a real-time API request. As a result, these “batch” decision tasks end up becoming complex processes that require a lot of technical time and resources to implement.

To enable teams to unlock the full potential of automation, Taktile has launched a new feature: Jobs, a powerfully simple tool that empowers teams to schedule automated decisions that run over large datasets without being initiated by a real-time API request.

This feature allows teams to safely and transparently undertake portfolio monitoring activities without relying on engineers - from eligibility assessments to periodic rescoring.

Let’s delve deeper into the example of portfolio rescoring:

After onboarding a customer, regular portfolio rescoring can be beneficial to safeguard against unexpected repayment risks and maximize each customer's lifetime value.

For example, after providing a credit line, you may want to increase or decrease a customer's credit limit, depending on their financial behavior while using your product.

To do this on a portfolio-wide basis, you can utilize Taktile’s Job feature to periodically trigger an automated Decision Flow that rescores certain segments of your customer database.

A Decision Flow in this context may analyze various inputs similar to your initial scoring decision-making criteria, such as recent open banking data and credit reports, to assess a customer's real-time repayment ability. Then, it may direct those customers requiring further review to your internal teams or automatically adjust a customer’s credit limit or pricing based on the outcome of the assessment.

Setting up a Job on Taktile involves three key steps:

1. Choose the relevant Decision Flow

2. Specify your preferred data source; this could be a file or SQL query to your customer database

3. Select the schedule that best fits your requirements

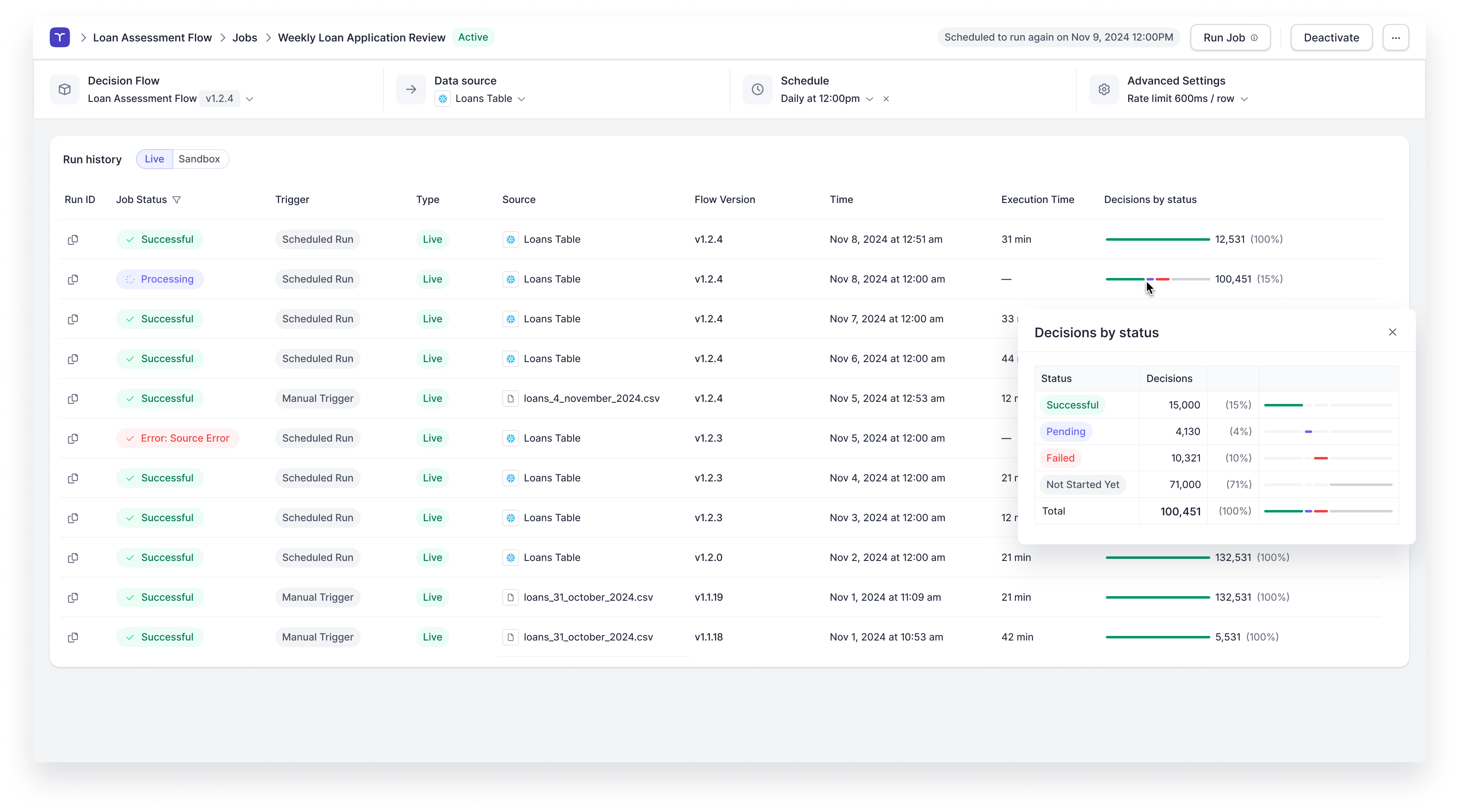

In the case of periodic rescoring, teams usually define unique schedules for specific segments of their customer portfolio. For example, weekly rescoring for all customers who have been issued a loan in the past 3 months. Jobs give you the flexibility to design use cases tailored exactly to your needs.

"Ever since launching Novo Funding using Taktile’s decision engine, our ability to venture into new use cases for proactive risk management has been effortless. Beyond our initial credit decision-making use case, we've established multiple new use cases, such as automatic credit limit adjustments, to better manage our portfolio risk," shared Nancy Lopez, Credit Exposure and Pricing Strategist at Novo.

Once created, team members can test a Job in the Sandbox environment before the workspace admin makes it live. Then, in terms of maintenance, the responsible team members can adjust them as often as required.

As Shikhar Varshney, Senior Engineering Manager at Novo, explained, “I’m a strong advocate for giving credit analysts the autonomy to own and manage as many aspects of their work as possible, including setting up and adjusting portfolio monitoring activities. Taktile’s new Jobs feature enables the credit and risk teams at Novo to do exactly this.”