B2B, Fintech, Lending 3 min read

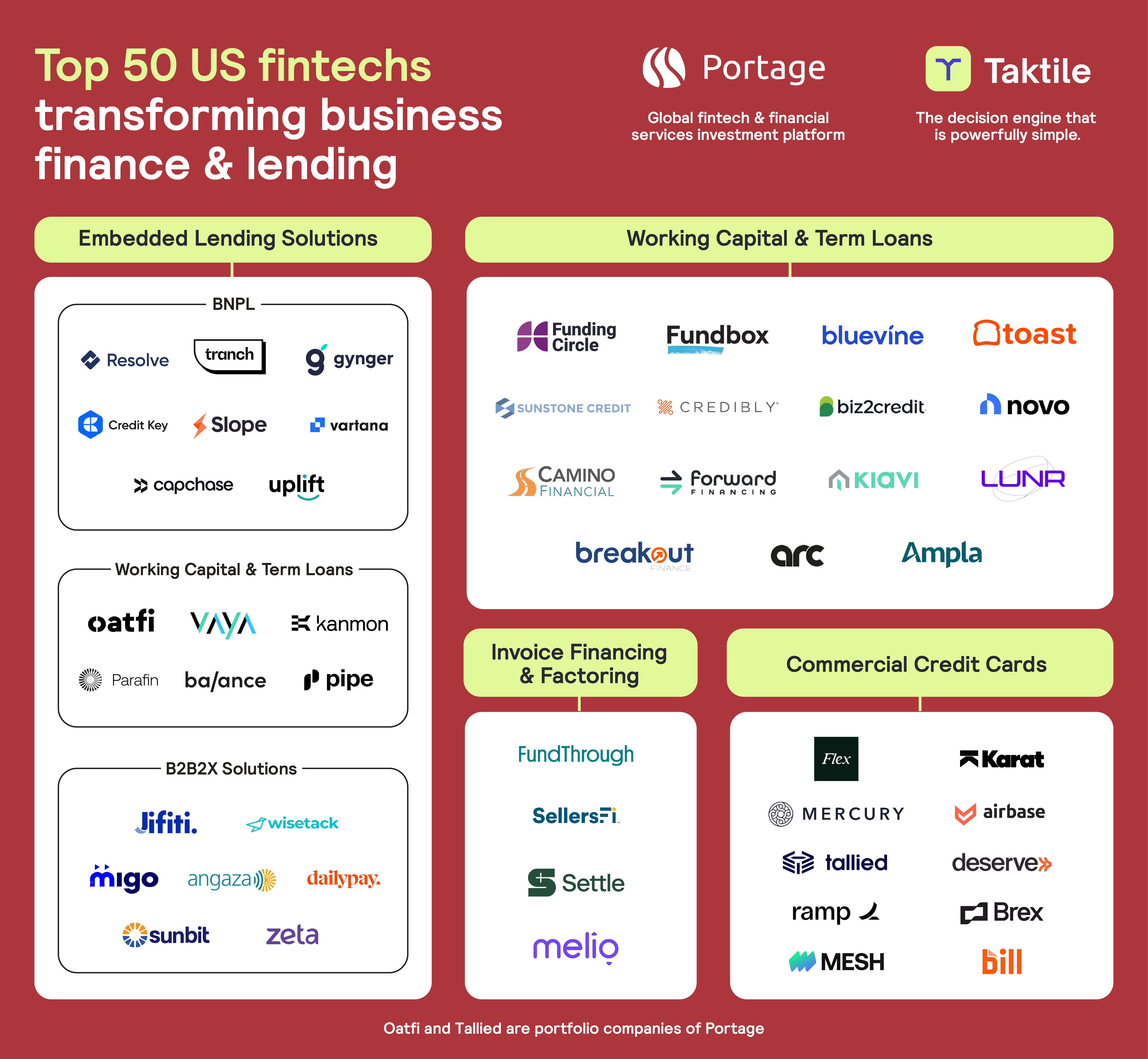

US Spotlight: Top 50 fintech companies transforming business finance & lending in 2023

This year, B2B finance has experienced unprecedented growth as fintech and vertical SaaS companies have harnessed cutting-edge technologies to create innovative B2B financial solutions.

Many of these companies have become highly sought-after VC magnets, particularly in the United States (US), with Portage, a global investment platform in fintech and financial services, witnessing this growth firsthand:

“The continued and anticipated growth in B2B transactions brings along new challenges across a multitude of industries and different sizes of business. From topics such as cross-border complexities to increased compliance and underwriting risks, we see technology at the center of this perfect storm.”

Taktile, a powerful decision engine software provider, has also been actively involved in this US growth story, collaborating with numerous leading B2B fintech lenders who are turning risk into a competitive advantage.

In collaboration, Taktile and Portage have identified the top 50 US fintechs that we believe are at the forefront of business finance and lending innovation in 2023. In addition, we present an overview of the diverse offerings that have been instrumental to the sector's growth.

Embedded lenders find their feet in B2B

Due to the average size of B2B sales transactions, the global market for B2B payments far surpasses the B2C market. Coupled with the increased business need for finance to acquire goods and services, we believe that there is immense potential for fintechs to serve this market.

In the current landscape, embedded B2B lenders have undoubtedly proven product-market fit thanks to innovative technologies that have unlocked new avenues. Ranging from Buy Now, Pay Later (BNPL) to B2B2X solutions, the ability to reduce friction in the sales process is evolving into a crucial competitive differentiator for companies.

BNPL solutions

For years, consumers have enjoyed the convenience of embedded BNPL solutions from the likes of Affirm and Klarna, but this year, the spotlight is well and truly on B2B.

Having finally cracked the real-time underwriting process for smaller B2B loan amounts, fintech companies are now able to offer businesses more payment flexibility. Companies such as Resolve, Credit Key, and Uplift are leading the pack, having developed convenient white-label BNPL solutions for businesses to integrate into their B2B sales processes.

By using these solutions, businesses can offer their customers near-instantaneous credit approvals, increased payment flexibility, and opportunities to grow their average order volumes.

Working capital and term loans

2023 has also seen fintechs strongly adopt advanced data analytics and machine learning to create hyper-personalized working capital and term loans in an embedded setting.

Parafin, for example, analyzes a business's proprietary data, such as its marketplace and e-commerce data, to offer flexible lending solutions – even if a business has little to no credit history.

These quick and easy financial solutions have been game-changing for small businesses and entrepreneurs who have historically struggled to access credit due to their lack of credit history.

B2B2X solutions

We are also witnessing the emergence of impressive B2B2X solutions that go beyond the status quo.

OatFi, for example, has built a market-first platform that enables other B2B platforms to seamlessly embed cashflow tools into any B2B payment flow. Using OatFi’s infrastructure, business clients of these platforms can accelerate their receivables, defer payables, and better manage their working capital.

On the other side of the spectrum, DailyPay is a platform businesses can use to provide their employees with on-demand pay — also known as earned wage access. This innovative solution gives employees access to their earned pay before the traditional, scheduled payday.

Automation and alternative data are key to unlocking B2B finance

To keep up with the demand for faster, more inclusive financial products – lenders are feeling the pressure to improve the speed, accuracy, and volume at which they make underwriting decisions.

According to Taktile’s research, almost 60% of B2B lenders plan to increase the automation of their underwriting processes by at least 5 percentage points in 2023. In addition, 58% of B2B lenders say enhancing their underwriting decisions with new data sources is a top priority this year.

Thanks to recent breakthroughs in decision engines and open banking data providers, B2B lenders are now achieving unseen levels of innovation in their underwriting processes.

Working capital and term loans

In the US, we are seeing several fintech companies lean on automation to successfully launch and scale B2B working capital and term loan products.

Novo, a small business banking platform, used Taktile’s automated decision engine to build its working capital product in under 3 months. Leveraging Experian data integrations, it built automated decision flows that streamlined its application process to under 10 minutes and helps them make credit decisions in less than 24 hours.

Novo and companies like Bluevine and Fundbox leverage automation not only to secure a competitive advantage with faster and more precise underwriting processes but to also increase their decision-making capacity.

Learn more about how automation is transforming B2B underwriting.

Invoice financing and factoring

Combining multiple alternative data sources to make underwriting decisions has become increasingly popular and has opened up significant new opportunities for B2B invoice financing and factoring.

Settle assesses risk by combining a business’s accounting and bank account data to create a highly accurate and holistic view of its financial situation. This approach allows lenders to significantly expand the number of eligible customers they can serve and drastically improve the accuracy (and, therefore, competitiveness) of their pricing.

Commercial credit cards

The use of alternative data sources has also revolutionized the commercial credit card. By leveraging multiple financial factors in their risk assessment of customers, fintechs have been able to create credit cards with flexible limits suitable to a wide variety of businesses.

For instance, Brex has created a commercial credit card that determines eligibility and limits based not only on business revenue but also on dollars raised. This has significantly increased access to finance for younger businesses like pre-revenue start-ups.

Furthermore, Mercury has built a Google Workspace integration into their commercial credit card product that allows businesses to more easily issue credit cards (in bulk if needed) – and, as a result, keep up with the pace at which they scale.

Future outlook

With an ever-growing demand for business credit, it is no surprise these innovative and highly accessible B2B solutions have created a booming new subsector within the finance industry.

Looking ahead, we anticipate a substantial uptick in fintech companies harnessing data and automation to elevate the sophistication of their B2B underwriting operations and compliance strategies. Many in the industry are just beginning to grasp the vast potential of these cutting-edge technologies.

One notable trend on the horizon is the rapid growth of AI-driven B2B underwriting. Venture capitalists have been increasingly directing their attention to AI-driven finance activities throughout this year as AI continues to alter the traditional financial landscape as we know it.

While good unit economics and strong fundamentals will remain integral to the success of B2B fintechs, we anticipate continuous growth in this dynamic industry as innovation continues to gather momentum.

As this next chapter unfolds, we look forward to seeing how fintechs evolve to cater to the substantial number of businesses that need fast and accessible financial solutions.

About Portage

Portage is a global investment platform focused on fintech and financial services with US$2.5B under management. Its team partners with ambitious companies across all stages through Portage Ventures and Portage Capital Solutions. It provides flexible capital and delivers a global network of investors, commercial partners, advisors, and value-creation experts. Its dedicated value creation team provides portfolio companies with hands-on support in go-to-market, tech & cyber, business acceleration and M&A, and partnerships to accelerate their paths to success. With deep industry knowledge and entrepreneurial experience, Portage is committed to supporting the leaders who are reshaping financial services. Portage is a platform within Sagard, a multi-strategy alternative asset management firm with over $15B under management, operating in the United States, Canada, Europe, and the Middle East.

For more information, visit www.portageinvest.com