B2B, B2C, Data 4 min read

Unlocking open banking data: Strategies for cash flow-based underwriting

Thanks to open banking, lenders have unparalleled access to borrower data, allowing them to make underwriting decisions more accurately than ever before. This has led to lenders significantly increasing their approval rates, improving their pricing, and expanding their offerings to customers typically excluded by traditional lenders.

However, gaining access to open banking data is merely the first step. The crucial challenge for lenders is figuring out how to effectively use open banking data to assess their customers' affordability and repayment risks.

To tackle this complex topic, Taktile CEO and Co-founder Maik Taro Wehmeyer sat down with Finovate and industry experts Abhinav Swara (VP and Head of Credit Risk at Bluevine) and Jonathan Gurwitz (Credit Lead at Plaid) to discuss the cash flow-based underwriting approach in-depth.

We have recapped key takeaways from the webinar discussion, including:

How cash flow-based underwriting evolved over time

The potential for cash flow data to revolutionize consumer and business underwriting

How lenders are approaching cash flow-based underwriting today

Challenges in adopting a cash flow-based underwriting approach

If you want to watch the entire discussion of these topics, we invite you to watch the webinar.

Key takeaways

- Cash flow-based underwriting is transforming credit risk assessment: By leveraging open banking data, lenders can evaluate real-time income and expenses, improving affordability checks beyond what credit bureau scores reveal.

- Open banking expands financial inclusion: Cash flow insights allow lenders to approve credit-invisible consumers and provide flexible credit lines to small businesses traditionally underserved by legacy underwriting models.

- Effective adoption requires data mastery: Winning lenders integrate open banking APIs, clean and categorize transactions into usable attributes, and embed cash flow analytics directly into automated decision engines.

- Challenges persist in data access and interpretation: Fragmented regulations, incomplete geographic coverage, and the difficulty of deriving predictive signals from raw bank data remain major hurdles for scaling cash flow underwriting.

- Underwriting infrastructure is the growth lever: Decision platforms like Taktile help lenders operationalize cash flow underwriting with API connectivity, experimentation capabilities, and decision automation—unlocking faster, more accurate lending.

How cash flow-based underwriting has evolved over time

Jonathan explained that cash flow data has always been a critical underwriting component. Lenders often think about risk assessment in two facets: someone's willingness to pay and their ability to pay. Cash flow data is particularly beneficial in assessing the latter.

Historically, collecting borrower cash flow data was painfully cumbersome. It was time-intensive, expensive, and prone to fraud and manual error. Therefore, it often took a backseat in the underwriting world compared to traditional data from credit bureaus.

Over the past decade, however, the use of cash flow data evolved significantly with the acceleration of open banking data providers like Plaid. Now, the overall experience and interplay of cash flow data between lender and applicant has become frictionless.

On the lender side, they now get digitized cash flow data, which they can use to build granular insights and attributes about a borrower’s ability to pay. And as a result, can undertake deeper risk evaluations and create highly efficient, automated decision processes.

Plus, for applicants, the process of sharing and permissioning information has become effortless; now, they can link their account data in under 10 seconds – which has led to far superior customer experiences.

Harnessing potential: How cash flow data is revolutionizing consumer and business underwriting

Consumer underwriting: A simple but powerful space for innovation

Jonathan mentioned that although the online personal loan space may seem simple at face value, open banking has enabled some serious innovation.

Not only does seamless access to cash flow data enable lenders to give out offers instantly, but it also helps them significantly grow their acceptance rates, plus the inclusiveness and competitiveness of their products.

Maik explained how traditional credit bureau data has weaknesses, especially when assessing the risk of minority customer segments. If you were an immigrant, for example, who had just moved to a new country – without a credit history, traditional lenders would not even consider you for a loan.

“The pulse for a lender should be the financial health of its customers, and cash flow data has the ability to represent this exceptionally well.”

Now, lenders are becoming increasingly sophisticated at using cash flow data in the overall decision-making process – using it to augment traditional scores to predict the probability of default (PD).

Business underwriting: The segment being unlocked by alternative data

Abhinav explained that 10 years ago, business underwriters heavily relied on traditional data sources – with almost all credit risk models being based on credit bureau and financial statement data. However, this has significantly shifted.

Instead of trawling through financial statements to assess affordability, lenders can instantly access digitized business cash flow data through open banking providers. Abhinav highlighted how this has revolutionized cumbersome application processes and made underwriting decisions much faster.

Maik explained how valuable business cash flow data has also been for providing accurate, real-time insights that financial statements cannot offer to lenders – enabling them to loan out larger, more flexible credit lines to more borrowers.

Bluevine’s cash flow data-driven risk models enable them to lend to businesses that traditional banks otherwise would not touch. In the past few years, around 40% of its lending has been to minority businesses, which would not have been possible using only traditional data sources for risk assessment.

Abhinav believes there is still enormous opportunity for innovation in the business lending space and that the industry is only just getting started when it comes to leveraging the true power of cash flow data.

How lenders are approaching cash flow-based underwriting today

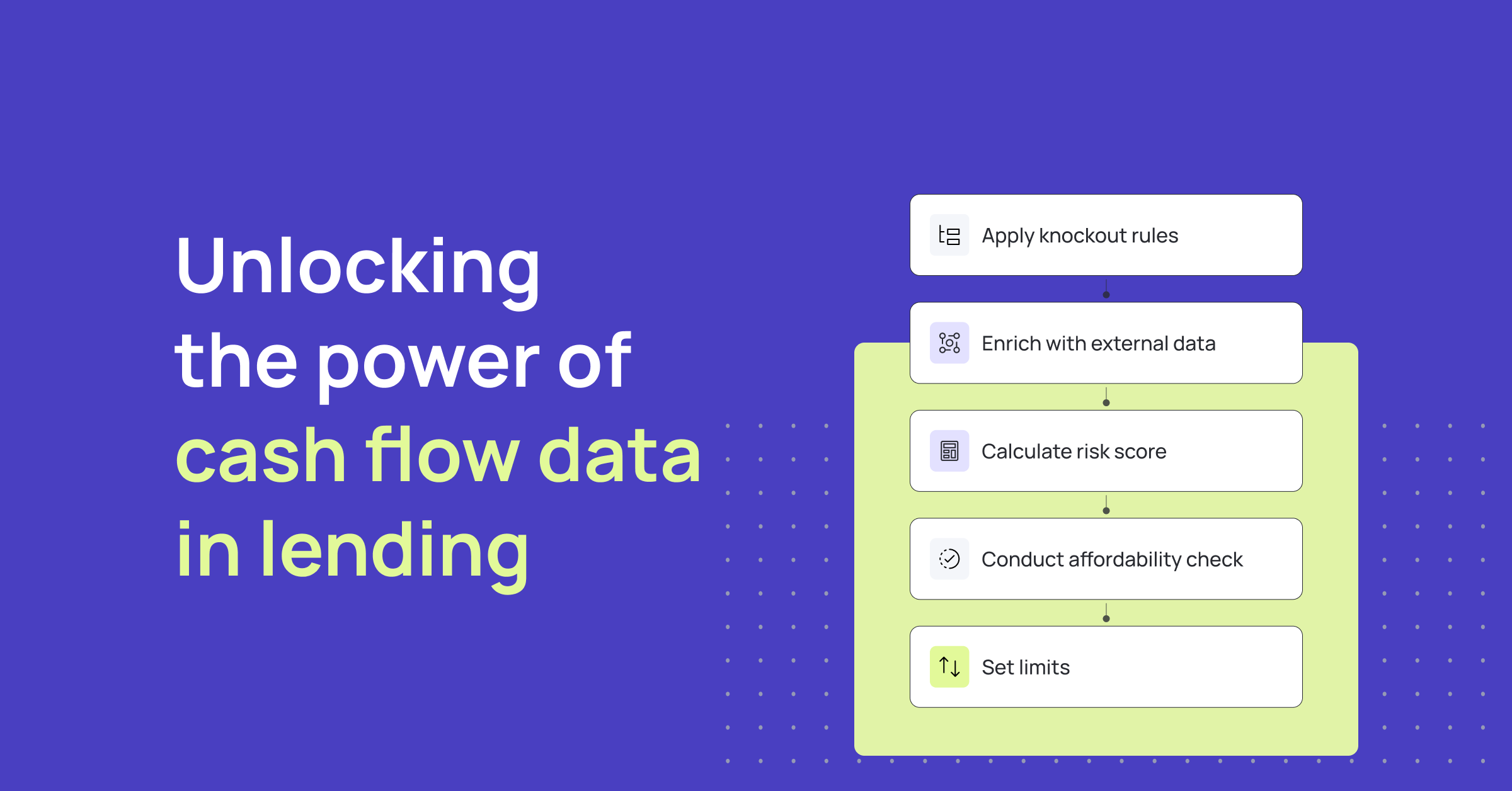

When developing cash flow-based underwriting models, Abhinav explained there are three main buckets to focus on:

1. Integrating and consuming cash flow data

How you integrate and consume data often comes down to your acquisition strategy. At Bluevine, for example, it first opts for customers to connect to Plaid to give them a seamless data-sharing experience. At Taktile, Maik has seen many successful examples of lenders increasing their acceptance rates by designing their application process in this way.

However, at Bluevine, there is also an option for customers to provide manual statements if they prefer.

“Each company tends to have a slightly different approach to integrating and consuming data. But ideally, you should integrate as much as possible through a seamless open banking provider.”

2. Cleaning and interpreting cash flow data into your underwriting models

Lenders must be able to accurately capture income and key expenses from cash flow data to get a granular view of their customers.

However, the cleaning and categorization of cash flow data can be tricky. Bluevine has invested heavily in developing intelligence around transaction tagging, categorization, and deriving insights from cash flow data so that it’s helpful in their underwriting models.

Jonathan highlighted how Plaid has also spent a lot of time iterating, evaluating, and updating its models to capture lender and credit-specific categories.

Abhinav mentioned how, with income, for example, it’s essential to develop processes to differentiate actual revenue sources from incoming payments from other loan providers or fraudulent schemes.

Once categorized, lenders can then use the data to build custom attributes that pertain most closely to their business and the underwriting they are looking to do.

Jonathan mentioned how Plaid provides an attributes library where they share the logic with lenders – to fast-track the transformation of data into actionable insights. Plus, it has now developed out-of-the-box insights that can provide lenders with predictive attributes to help customers get to market quicker.

3. Continuously optimizing your approach

Over time, you must continuously improve and monitor your interpretation of cash flow data. Maik pointed out how Taktile has enabled lenders to easily build “data cascades” to optimize external data costs.

External data sources, whether credit bureau or cash flow data, provide different signals to predict PD. In data cascading, you want to determine which type of applicant you want to have which kind of signals.

On Taktile, Maik explained how business lenders tend to employ a mix of credit scores, cash flow data, and accounting data. However, they do not necessarily pull all these data sources for every applicant.

If a customer has a high credit score, many lenders often take this as a safe enough signal of PD. But for customers, you would typically reject based on credit score alone, you may want to triage and assess them in alternative ways using cash flow data to predict their PD.

Challenges in adopting a cash flow-based underwriting approach

1. Data availability

Access to cash flow data is not always straightforward, leading to friction in the account-linking process. This is because availability tends to differ depending on your geography.

In Europe, for example, lenders benefit from PSD2 regulation, where by law, banks must share data with third parties if permissioned by the customer. Whereas in the United States, for example, regulation around sharing bank account data has only just come into play this year.

Therefore, finding open banking providers that provide the coverage and accuracy you need in your geography is helpful. Jonathan mentioned that this is where Plaid comes in handy – they have already established data-sharing connections with 12,000+ institutions for credit and lending use cases.

2. Data usability

Jonathan mentioned how important it is that your underwriting infrastructure can connect seamlessly to external data providers.

“Plaid integrates directly into Taktile through a single API connection, which helps lenders readily access and build cash flow data into their decision models and strategies.”

In addition to infrastructure, Maik explained how deriving meaningful insights from cash flow data is another common challenge for lenders. Because of the relative newness of the modern cash flow-based approach, not many lenders have employed it long enough to have learned the best methods of leveraging cash flow data.

Finding the right signals for your use case, products, segment, and risk appetite can be tricky. However, Maik mentioned that on Taktile, lenders successfully overcame this challenge by rolling out experiments, testing thoroughly, and iterating quickly. This is where having underwriting infrastructure with experimentation capabilities is crucial – where you can have fast interaction cycles and undertake sophisticated back-testing simulations.

Some lenders that use Taktile roll out experiments to 15-20% of their customers to test and get insights before rolling out changes to their whole segment. Then, closely watch what value different data sources are adding.

3. Data connectivity

Addressing ongoing connectivity challenges is crucial for maintaining real-time insights into customers. Some banks mandate connection refreshes to customer account data every three months, posing a dilemma for lenders.

Without the most up-to-date information on a customer's financial health, conservative decisions might inadvertently lead to adverse actions. Abhinav mentioned that mitigating this challenge becomes imperative, especially when considering providing customers with future line increases.

Jonathan emphasizes the value of data over the customer lifecycle, underscoring the importance of the persistence of data provider connections. While sophisticated APIs are growing this stability, there's still work to be done to overcome these obstacles.

To learn about the future opportunities for innovation with this underwriting approach and listen to the panel answer insightful audience questions, we invite you to watch the full webinar.

Frequently Asked Questions (FAQs)

Q: What is cash flow-based underwriting in lending?

A: Cash flow-based underwriting is a modern approach where lenders use real-time income and expense data from open banking APIs to assess borrower affordability and repayment risk. This method goes beyond traditional credit bureau scores, enabling more accurate and inclusive lending decisions.

Q: How does open banking improve lending decisions?

A: Open banking allows lenders to securely access verified bank account and transaction data. By leveraging this data, lenders can approve previously “credit-invisible” consumers, expand small business lending, and offer more flexible credit lines.

Q: What are the main challenges in adopting cash flow-based underwriting?

A: Key challenges include inconsistent data availability across regions, the complexity of cleaning and categorizing raw bank transactions, and ensuring continuous connectivity for real-time insights. Modern decision platforms like Taktile simplify these hurdles and accelerate implementation.

Q: How can lenders optimize cash flow data for risk assessment?

A: Lenders optimize cash flow data by categorizing transactions, creating custom predictive attributes, and continuously testing decision models. This allows for faster, automated lending decisions while improving approval rates and reducing default risk.

Q: Why should businesses consider cash flow-based underwriting now?

A: Cash flow-based underwriting is revolutionizing small business and consumer lending, offering faster approvals, higher acceptance rates, and more inclusive credit access. With the right infrastructure, lenders can harness real-time financial insights for growth and competitive advantage. Request a demo to see how Taktile’s AI Decision Platform enables cash flow-based underwriting for lenders.