B2B, Case Study, Lending 2 min read

Novo leverages Taktile to launch Novo Funding for small businesses

At Taktile, we are consistently proud when we see one of our customers launch incredible new products that transform their industry.

Today, Novo, the financial platform for small businesses, launched Novo Funding. Built on Taktile’s automated decision platform, Novo Funding will offer small businesses a fast and flexible way to access working capital.

This new initiative is critical for small businesses, many of whom lack access to capital. As Novo founder and CEO Michael Rangel notes:

“When a small business owner wants to invest in their business growth, or simply access some additional funding to cover an upcoming payroll cycle, they have incredibly limited options for accessing capital.

Some use credit cards with exorbitant interest rates, while others attempt to go through a weeks- or months-long application process with a traditional lender and aren’t able to access the capital until long after they need it

Novo Funding is built to provide the best working capital experience for small business owners, and support them with their short-term financial needs and long-term ambitions.”

This launch is the latest step for Novo, which has built a fintech platform for small businesses that combines a checking account with an ecosystem of financial applications — helping small businesses access their revenue faster and save time on business-critical tasks.

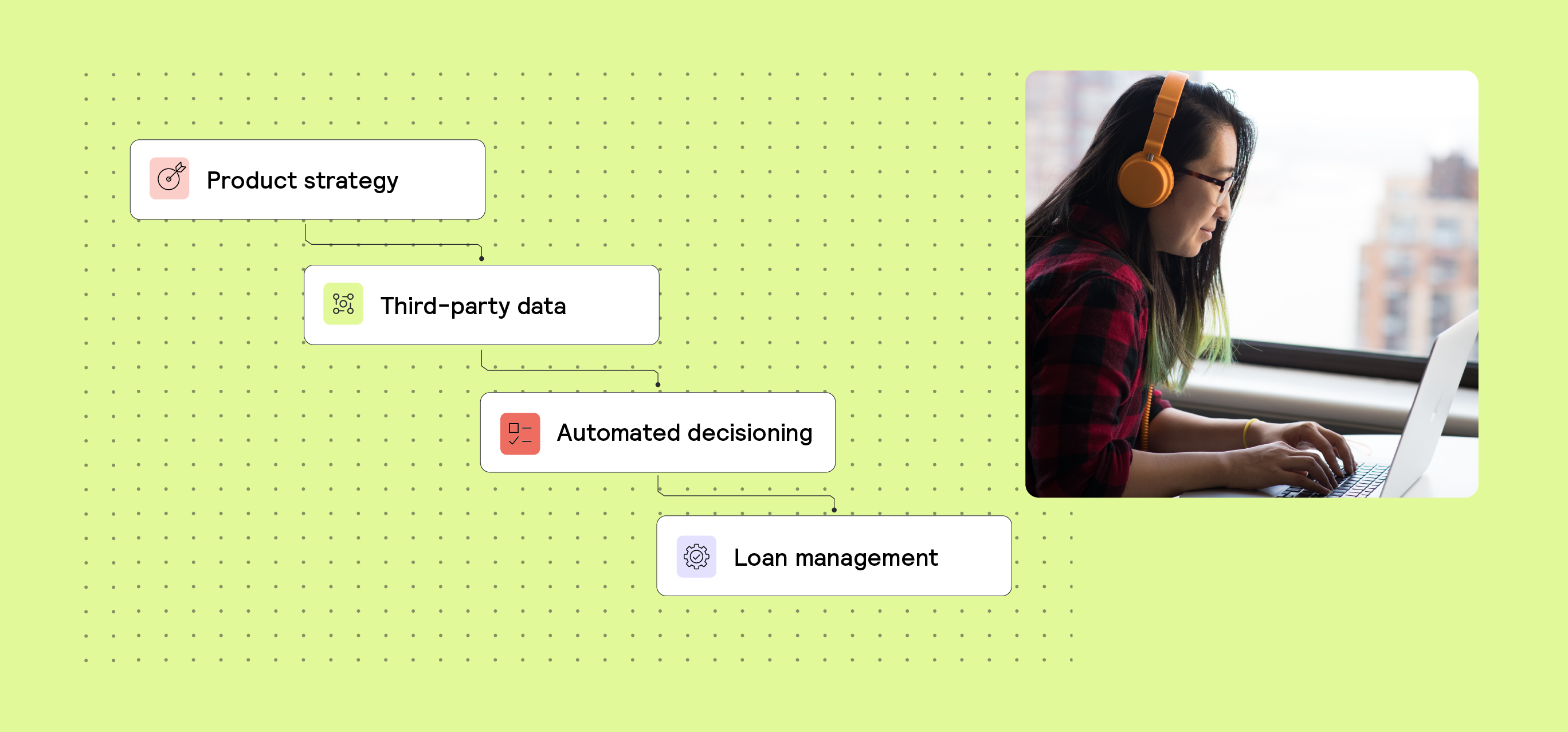

Using Taktile, Novo was able to launch Novo Funding from scratch in under 3 months. Taktile’s low-code platform made it easy for the credit team and engineers to collaborate so that they could quickly implement credit policies, bring logic into production, and leverage data from key providers, such as Experian, to make accurate credit decisions. Novo was also able to leverage Taktile to automate nearly 100% of decisions, which helped streamline the application process. The Novo Funding application can be completed in under 10 minutes, and Novo will complete its review within 24 hours of receiving the application.

While Novo Funding launches in full this week, it has already proven to deliver remarkable benefits for small business owners.

According to Kevin Phillips, EVP of Credit at Novo:

“After completing a pilot of Novo Funding in which thousands of small business owners accessed more than $35 million, we heard time and again how Novo Funding was by far the best option for accessing capital. There’s simply no other small business working capital product on the market that combines the speed and simplicity of Novo Funding. Taktile has been an incredible partner in this effort and empowered us to launch Novo Funding with ease.”

We’re excited to support Novo in their continued growth and commitment to delivering for small businesses.

Disclosure:

Novo Platform Inc. (“Novo”) is a fintech, not a bank. Banking services provided by Middlesex Federal Savings, F.A. Member FDIC.

Merchant Cash Advance products and services are offered by Novo Funding LLC (“Novo Funding”), a wholly owned subsidiary of Novo. Merchant Cash Advances require a Novo checking account.