Key takeaways

- Silvr is redefining SME lending with data-driven underwriting: By combining proprietary scoring with fast, automated processes, Silvr enables small businesses to access €5,000–€1 million in funding in just days.

- Scaling demand required smarter automation, not just more staff: To keep up with rapid growth, Silvr leveraged Taktile’s decision engine to streamline credit assessments and scale underwriting efficiently.

- Taktile’s Decision Platform makes risk evaluation seamless: Low-code nodes allow Silvr to integrate data sources, apply knockout rules, and generate instant eligibility outcomes in a single click.

- Automation boosted loan approvals and efficiency by 8x: With faster eligibility checks and real-time credit policy iteration, Silvr multiplied signed loan fundings per employee while reducing application review times.

Meet Silvr: The lending innovator empowering businesses

Silvr has emerged as a significant industry player in the ever-evolving landscape of business lending.

With a vision of empowering business owners, Silvr's state-of-the-art approach to risk assessment has streamlined the process of unlocking access to funding for SMEs, making it more flexible and efficient.

Silvr employs a unique data-driven scoring method that enables it to offer SMEs financing that ranges from €5,000 to €1 million across various use cases, including inventory and growth financing. This approach also enables customers to complete the application process in under 5 minutes and access funding within days.

The opportunity: Scaling to meet demand

Having secured an impressive €330 million in equity and debt financing and a strong product-market fit, Silvr has witnessed exceptional growth since launching in 2020.

As a result of this rapid growth, Silvr's Head of Operations, Sébastien Allain, set out to optimize Silvr’s underwriting process even further so it could scale its operations efficiently to serve more businesses across Europe.

The innovation: Enhancing expertise with automation

Rather than simply replicating the existing process at scale, Sébastien decided to combine Silvr’s state-of-the-art underwriting approach with Taktile’s risk decision engine to grow the automation of its risk assessment process.

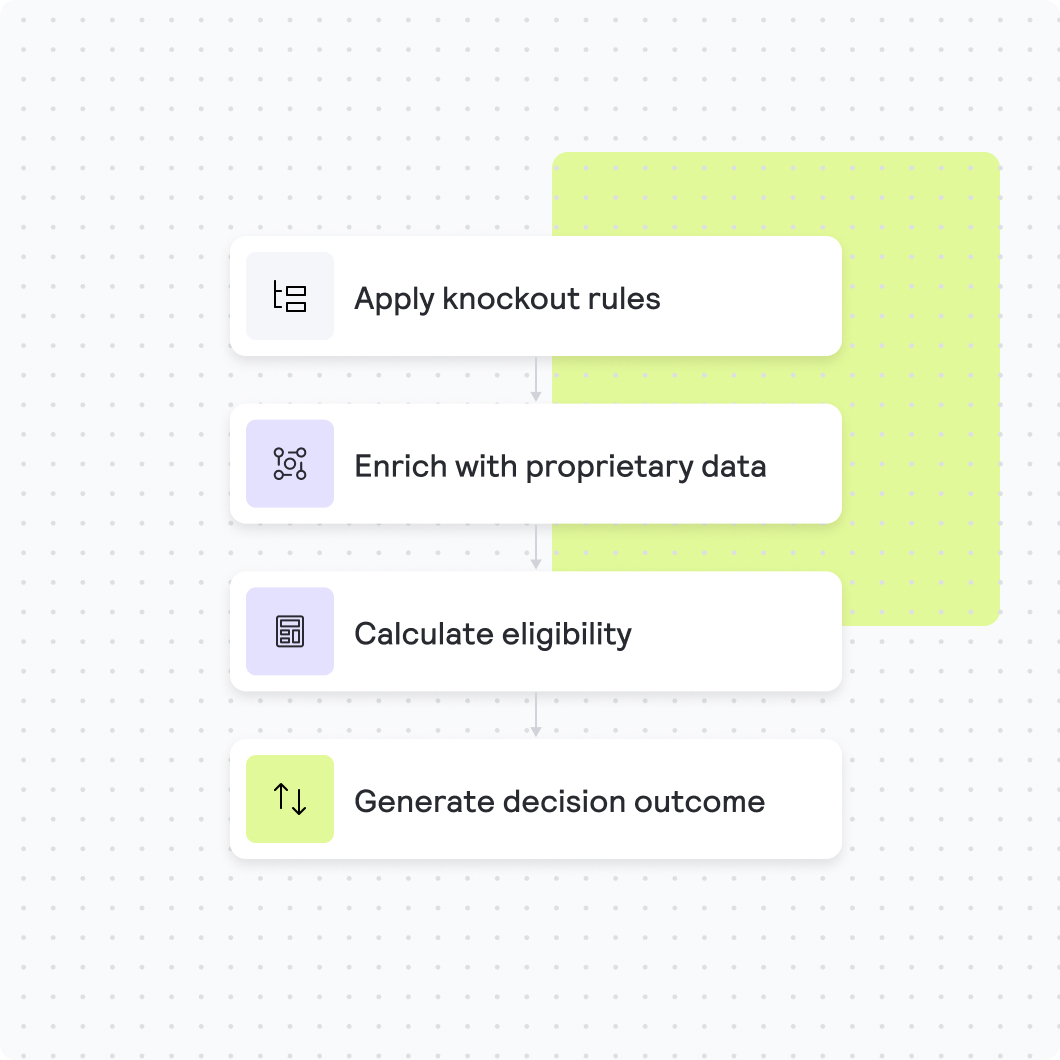

Using the Taktile platform, the Silvr team was able to build out its credit assessment into a ‘Decision Flow’ through the use of various low-code ‘Nodes’ that:

- Test for initial credit criteria, such as knockout rules

- Seamlessly integrate with Silvr’s proprietary data sources

- Calculate a customer's eligibility using Silvr’s expert risk criteria

- Generate a precise and actionable decision outcome that is integrated with the rest of the automation flow at Silvr

Now, using its Taktile Decision Flow, Silvr can quickly upload a borrower's data, run a risk assessment, and download the outcome of the decision all in one click.

The result: Taking growth to the next level

Since the implementation of Taktile’s decision engine, Silvr's capacity to service more of the European SME market has been enhanced.

1. Strengthened ability to assess loan applications

As a result of increasing the automation of its underwriting process, Silvr has gained more efficiency in its application review process.

“Using Taktile, we have multiplied by 8 the number of signed fundings reported to our full-time employees," says Sébastien.

The speed at which the support team can move applications forward to the risk team for approval has also improved. As Sébastien explains, "The support team can more quickly determine customer eligibility before passing on an application to the risk team, which has been a big efficiency gain for us."

2. Substantial boost in loan approvals

With the efficiency gained by beginning every decision on the Taktile platform, Silvr has significantly increased its loan volumes.

“With Taktile's intuitive interface, we're able to rapidly iterate on versions and thresholds within our credit policy, streamlining the process of testing and refining. This accelerated approach has resulted in a significant reduction in the time it takes to assess loan applications, ultimately enabling us to significantly increase our underwriting volumes”, says Sébastien.

3. An integrated approach that drives growth and fosters innovation

In addition to setting the stage for efficient, scalable growth within its existing markets, Silvr has already found Taktile beneficial when it comes to operating in multiple geographies.

"We're continually uncovering new advantages of using Taktile," Sébastien remarks. "Lately, we've found that Taktile is really effective for comparing credit decision logic across geographies – something critical for us as we continue to innovate on our local underwriting strategies."