B2C, Case Study, Lending 2 min read

Growing profitably in 2023: Advice for state-of-the-art lenders

Over the past years, many fintech startups focused on growth at any cost. But in 2023’s new funding environment, that has changed. Now, money is expensive, and fintechs must focus on profitability and extending their runway to be successful.

Key takeaways

- Profitability is now as critical as growth, and focusing on sustainable unit economics can make a startup attractive even in a challenging funding environment.

- India-based healthcare startup SaveIN demonstrates that prioritizing profitability from day one can drive rapid growth and secure funding, even in a tough venture environment.

- Choosing an efficient go-to-market strategy reduces customer acquisition costs and accelerates expansion.

- Strong risk management and early investment in a risk decision engine are essential for sustainable lending growth.

- Building robust data infrastructure and using a centralized decision engine allows lenders to make faster, more accurate, and scalable decisions.

- Real-time monitoring and agile decision-making enable rapid adjustments in response to market or operational changes.

The success story of SaveIN, a health-care startup in India

SaveIN, a Y-Combinator-backed healthcare fintech startup in India, has been ahead of this curve. Launched in 2022, SaveIN offers embedded finance at healthcare centers across India, helping to make private healthcare accessible and affordable. Healthcare is a $50B+ market opportunity for SaveIN. Over 85% of healthcare expenses in India are borne out of pocket since less than 10% of the population is covered by private insurance. Recognizing that profitability would be critical to their success, SaveIN focused on profitable growth from the start rather than pursuing growth at any cost.

This bet paid off: in its first year after launch, SaveIN is now enabling zero-cost monthly installments (EMIs) across more than 2000 healthcare providers in India. The company’s revenue has grown by over 80X within 11 months of launch, and it is already processing tens of thousands of applications per month. Building on this success, SaveIN successfully raised $8M in seed funding over the last 9 months, even raising the last portion of the round in December 2022, despite an extremely challenging venture capital funding environment.

To learn how SaveIN accomplished this growth while maintaining positive unit economics, we spoke to its CEO, Jitin Bhasin. Here are his suggestions to lenders who are trying to achieve profitability while continuing to scale:

8 tips for achieving growth and profitability

1. Consider your go-to-market strategy: New lenders should carefully consider their go-to-market model. SaveIN decided to launch in a B2B2C format because it would reduce the cost of acquiring customers. According to Bhasin, this strategy is one of the biggest differentiators for the company, given the sheer size of the country. SaveIN is already present in over 60 cities by focusing on a technology-first approach.

2. Prioritize risk: “The business of lending is risk. It’s not money, it’s risk management.” explains Bhasin. “Growth is important, especially for a young company, but if you’re a lender, you need to invest in risk. If you want to have skin in the game in terms of balance sheet exposure, it’s impossible not to think about risk.”

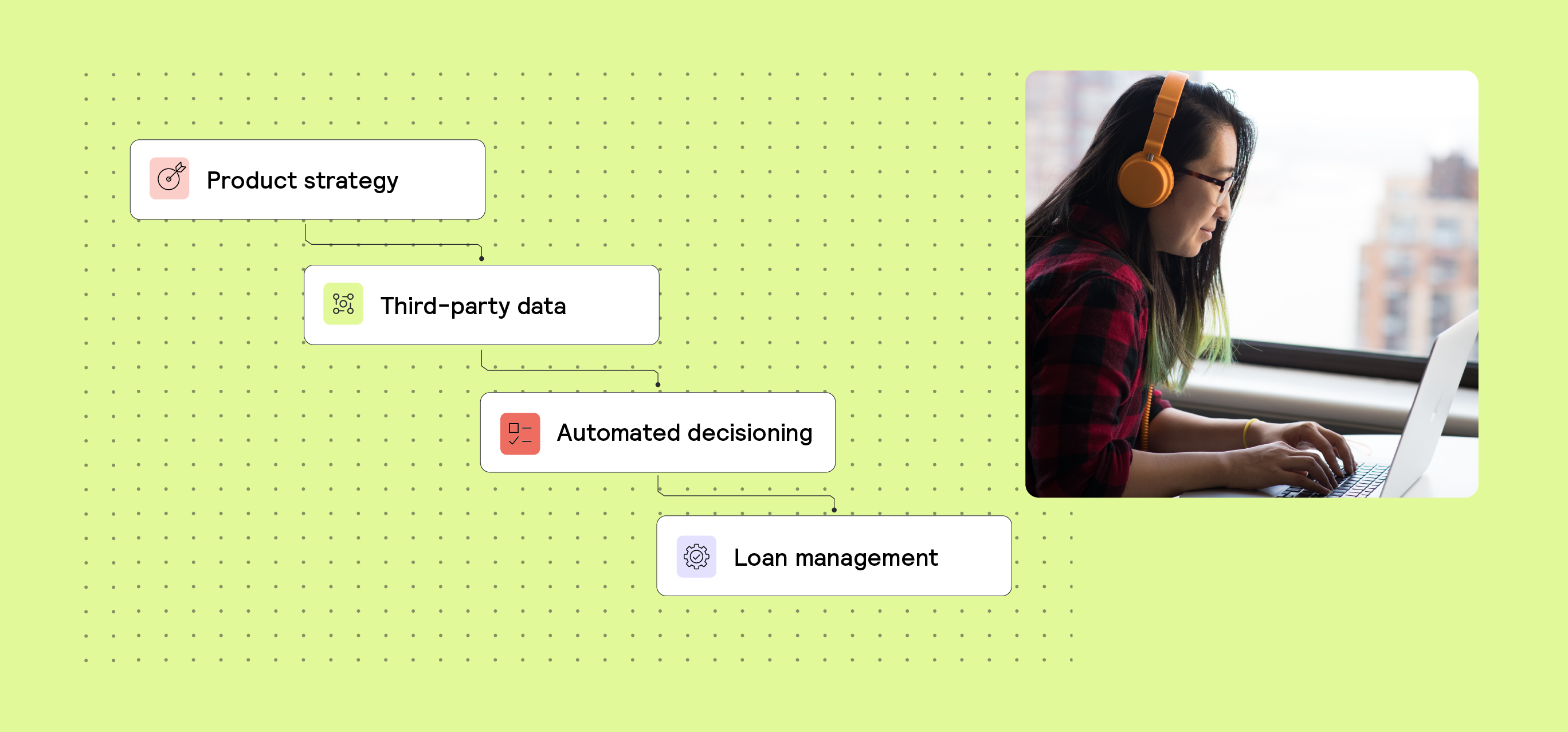

3. Invest in data infrastructure: “Invest in the proper setup of databases early and be very clear about how data should flow and how different data sources should talk to each other”, says Bhasin.

4. Identify the right KPIs: With hundreds of data points involved in each decision, you need to incorporate data analytics tools from the start to separate signals from noise and identify the most predictive features for your customer segment. “Turning raw data into insights is front and center when it comes to making good decisions,” shares Bhasin.

5. Use active monitoring tools: Ensure you can monitor data outcomes and decisions in real time. “You need to see what is working and what is not immediately so that you can adjust your models and policies,” explains Bhasin.

6. Get a risk engine: It’s never too early to invest in a good risk engine. “Take a leap and get a risk engine,” recommends Bhasin. “Do not be a slave to development by building and maintaining your own internal system.” He continued, “At SaveIN, we are very focused on profitability. We brought on Taktile early to set us up for success.”

7. Be nimble: Make sure you can adjust your decision flows easily. “You need to be nimble and agile in this environment. Having a risk engine makes it easier for you to rapidly respond to changing climates,” shares Bhasin.

8. Make your decision engine your source of truth: Once you have a decision engine in place, enrich your data. “Enrich Taktile or the decision engine you use and make it your bible. Bring in all of your data, so you have one central hub for all of your decisions.”