B2B, B2C, Lending 5 min read

Beyond credit scoring: A decision-making framework for profitable lending

Most lenders rely on application scoring to determine the default risk of applicants when making lending decisions. The key instrument in a lender’s toolbox is the Probability of Default (PD) model, which guides the underwriting of credit risk. In order to lower the delinquency rates of bad loans and increase the approvals of good ones, lenders heavily invest in the continual improvements of these PD models to rank default risk with higher precision.

A common strategy lenders use to maximize profitability is leveraging credit scores to benchmark loans’ potential interest income against the expected credit loss. However, this approach has limitations as it solely relies on default probability as a primary driver, overlooking other critical factors.

While PD models are instrumental in cutting losses and driving portfolio growth, they are not designed to predict what lenders really want. Credit scores represent only a fraction of a broader framework lenders use to achieve their goal of establishing a robust, high-return lending business. As a new status quo gains momentum, lenders are increasingly adopting a holistic approach to decision-making, which goes beyond credit scoring.

Introducing: The NPV framework

As the majority of lenders continue to rely on Probability of Default (PD) models for applicant default risk assessment and decision-making, many forward-thinking lenders have embraced a Net Present Value (NPV) culture in their decision-making processes. Under this framework, each loan is viewed as an investment decision, allowing lenders to closely monitor loan unit economics and ensure profitability across economic cycles.

We can express loan NPV as per the formula below:

Loan NPV = Loan Amount ($) x Price (%) - Cost of Risk (%) - CAC ($)

Price, Cost of Risk (PD or Net Credit Loss), and CAC can be viewed as key levers in determining the optimal points of lending decisions. This generic formula may also include other components (e.g., cost of capital and channel conversion rates), but in most cases, these three levers are sufficient to balance out growth and profitability.

For example, to accelerate portfolio growth, lenders can promote the lowest possible price (APR) based on a customer’s affordability and price sensitivity. Alternatively, to increase profitability, lenders can tactically pull the levers of Price and Cost of Risk to compensate for CAC. A precise control of a loan NPV thus allows to balance out growth and profit maximization targets.

Using the NPV approach, lenders can operationalize their goals to acquire profitable customers (for example, using NPV measured over six months of behavior) and focus on increasing the customer's lifetime value through cross-selling and engagement. Moreover, lenders might employ a specific discount rate for bookings (also known as a hurdle rate), enabling investors to embed Return on Equity (RoE) expectations into lending strategies.

Part 1: Pricing Innovation

Drilling down into NPV thinking, pricing is one lever that lenders try to tackle first when optimizing for profitability. In the context of consumer lending, the price of a product is the interest rate charged for using the lender’s capital. Aligning the risk appetite, that is, the extent of credit risk a lender is willing to take on, with the pricing model is paramount for maintaining a healthy and sustainable lending strategy.

A traditional instrument for pricing loan products is the Risk-Based Pricing (RBP) framework. The rationale for RBP is simple: more risky customers pay more to compensate for their risk. However, the problem is that a simple risk-based approach does not consider other aspects of customer behavior, such as a take-up rate (the rate at which customers accept offered credit terms in a competitive market). Ignoring other aspects can result in lost opportunities to attract lower-risk customers who might be sensitive to pricing but could positively contribute to portfolio returns.

Recognizing the challenges posed by traditional pricing approaches lays the groundwork for exploring how emerging players like FinTechs and Neobanks navigate these complexities.

Why pricing is crucial when thinking about profitability

Understanding the significance of the pricing lever is vital, especially in the context of newcomers to the lending space, including FinTechs and Neobanks. While these entrants may initially prioritize scale and market share, mirroring strategies that have thrived in the Tech and E-Commerce sectors, financial services are different. In this landscape, growth does not inherently translate into profits; instead, success hinges on skillfully aligning a product-market fit with a pricing strategy. This places a premium on designing lending products that are competitively priced rather than simply relying on the ability to disrupt traditional finance and revolutionize customer journeys.

The loan pricing process does not operate in a vacuum but rather is based on a dynamic feedback loop where the market influences how these prices are adjusted and updated so that lenders can remain competitive.

While for most consumer lending products (with the exception of credit cards), more risky customers display lower price sensitivity compared to less risky ones, these trends are not fixed. Customer segments evolve continuously, driven by changing demographics, economic shifts, and evolving consumer preferences. For example, as younger generations adjust their financial priorities or increase their savings, they might alter their sensitivity to pricing dynamics.

By strategically tailoring their product offerings and pricing models to meet the evolving needs of different customer segments, lenders not only enhance their through-the-economic-cycle profitability but also foster a growing and diverse customer base. This approach enables individuals to leverage a broader range of lending products to fulfill their aspirations, from buying a home and financing education to expanding a business or managing unforeseen financial hurdles, whether purchasing a home, funding education, expanding a business, or navigating unexpected financial challenges.

Pricing strategies come in all shapes and sizes

To effectively implement pricing strategies, lenders can employ various applications tightly linked to the NPV frameworks:

- Real-Time Pricing: This approach uses machine learning algorithms to analyze current market conditions, central bank interest rate projections, macroeconomic trends, customer behaviors, and risk assessments. By incorporating these factors, lenders can adjust their pricing in real-time to stay competitive and enhance profitability. Furthermore, by aligning pricing strategies with macroeconomic indicators, lenders can introduce buffers that anticipate future market shifts, ensuring more strategic volume origination.

- Segment-Level Pricing with New Data Sources: By collecting, authenticating, and analyzing comprehensive data on applicants' financial landscapes, lenders can refine their pricing models with greater precision. Consider the example of cash-flow data, which captures both inflows and outflows. This type of data offers a more granular view of the financial behaviors of consumers and small businesses compared to traditional credit scores. It provides enhanced sensitivity in recognizing shifts in an applicant's financial status, enabling more nuanced and timely pricing decisions.

- Innovative Product Design: By crafting unique product structures, like strategic bundling or tiered pricing models, lenders can stand out in the market and appeal to a wider audience. This method synchronizes Pricing with the perceived value of the product and the specific preferences of customers, enhancing both attraction and retention.

- Test and Learn Approach to User Feedback: By engaging in active dialogue with customers and implementing test-and-learn cycles for pricing within their risk management frameworks, lenders can nimbly adjust their strategies according to actual customer feedback. This iterative methodology facilitates the discovery of a sweet spot between ensuring customer satisfaction and achieving financial profitability.

By incorporating these applications into their pricing strategies, lenders can enhance their ability to navigate the competitive landscape, align pricing with customer expectations, and achieve sustainable profitability over the long term.

Part 2: Customer acquisition cost (CAC) innovation

In recent years, the expenses related to acquiring digital customers have surged, influenced by rising fraud rates and market saturation in the digital lending sector. Yet, this scenario offers lenders a chance to strategically lower customer acquisition costs (CAC) while maintaining steady profitability.

By refining decision-making criteria and prioritizing a customer's potential lifetime value over the upfront costs of acquisition, lenders are pioneering new heights in profitable lending practices.

The critical role CAC can play in profitability

The significance of the CAC lever extends beyond immediate profitability; it is a critical driver for sustainable growth through strategic cost management and cross-selling.

For emerging and niche entities in the lending market, particularly those facing an influx of new-to-bank customers with initial balances under $1,000—a common scenario among Neobank clientele—CAC optimization is paramount. Sole reliance on the transactional economics of debit card usage fails to yield sufficient profit margins, necessitating the cross-selling of additional, especially lending-related, products for financial viability.

These challenges, when approached as opportunities to refine CAC perspectives, enable such entities to forge lasting relationships and carve out distinct market positions.

A key to mastering CAC-based lending strategy optimization lies in the precise evaluation of customer acquisition's present value and the crafting of data-driven strategies to wield this strategic lever effectively. This not only sharpens CAC optimization efforts but also opens doors to previously untapped market segments, fostering long-term prosperity within the consumer lending sphere.

CAC strategies vary depending on your goals and risk appetite

There are several acquisition strategies linked to the NPV frameworks that lenders can employ to improve the management of the acquisition lever:

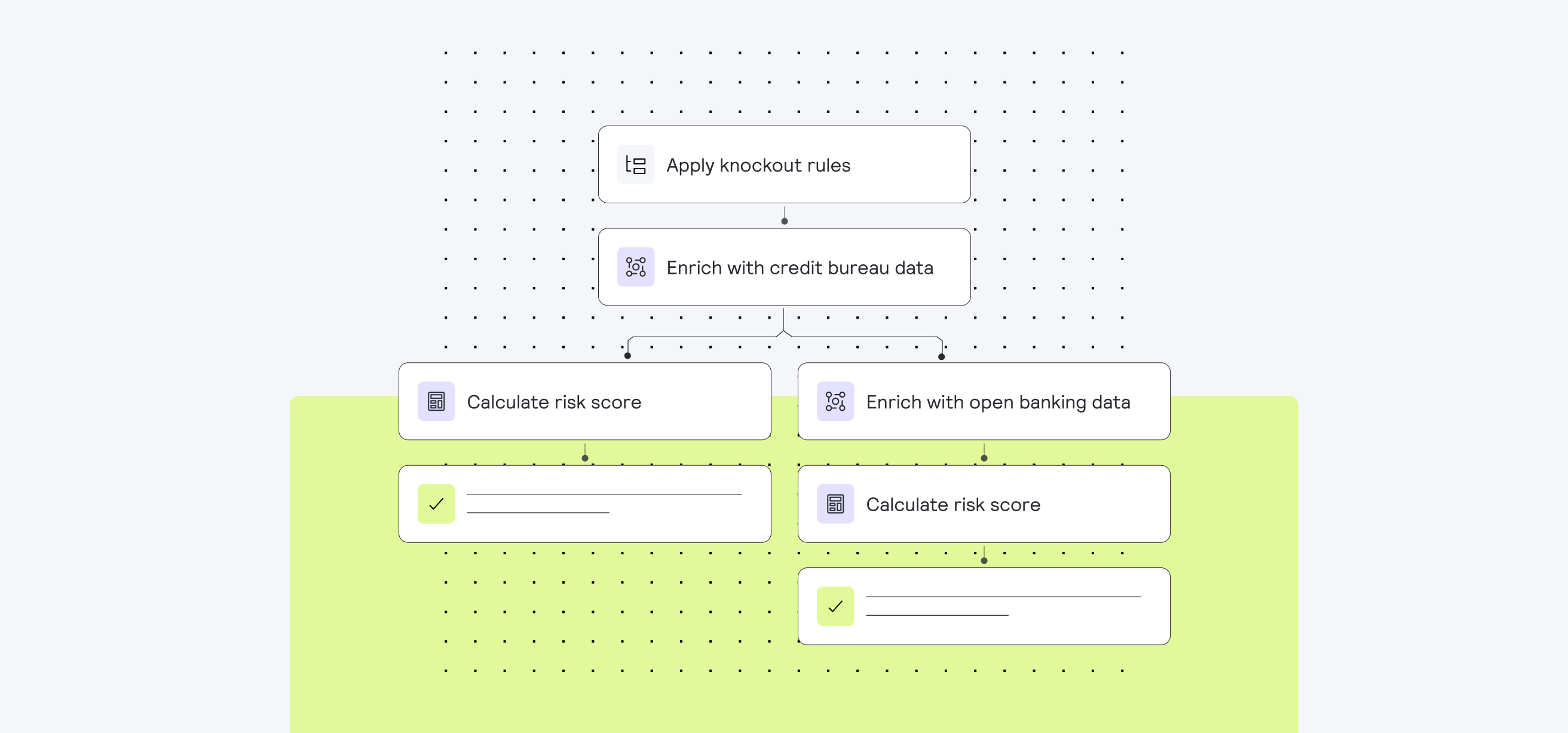

- Optimized data-driven acquisition strategy: Leveraging comprehensive external data about customer segments enables lenders to forecast the NPV of acquisitions and pinpoint customers likely to yield positive returns. This approach allows lenders to fine-tune the Customer Acquisition Cost (CAC) for new accounts, aligning it with the projected NPV of these accounts.

Here, being able to easily design segmented credit decision flows that follow a “waterfalled” approach becomes paramount, so you can ensure you’re only incurring data costs for the right parts of your segment at the right stage of the credit decision process.

- Network Layer: Leveraging partnerships and co-branding with retail and e-commerce providers allows to drive down acquisition costs by attracting new segments organically and retaining them with customized product offers.

- Tailored segmentation: Personalized treatments such as individualized promotions, channels, and messages for each unique customer segment can increase user engagement and establish formidable relationships.

Adapting these acquisition strategies can help lenders align with evolving market trends, enhancing their ability to identify valuable customers and foster long-lasting relationships to build out a foundation for future business growth.

The road ahead

In the fast-evolving and competitive world of lending, lenders are under constant pressure to refine their strategies for sustainable and profitable growth. While traditional methods like credit scoring and risk-based pricing have played a crucial role in managing risks and broadening portfolio outreach, they often fall short of directly targeting the ultimate goal of enhancing profitability.

The adoption of Net Present Value (NPV) frameworks marks a paradigm shift in lending practices, as evidenced by the market's top performers. This shift from focusing solely on risk minimization to emphasizing profit maximization represents a strategic milestone. Viewing each loan as an investment allows lenders to adjust profitability levers with precision, enabling decisions that harmonize risk with potential returns for every strategic move.

The focus on profitability, however, does not diminish the importance of risk management. On the contrary, risk appetite frameworks remain critical, offering a structured approach to defining acceptable risk levels and ensuring a buffer against potential losses. This balance between risk management and profit-oriented decision-making underpins a culture of prudent risk-taking, which is vital to ensuring the growth of a robust lending portfolio.

Frequently Asked Questions (FAQs)

Q: What is the NPV framework in lending and how does it work?

A: The Net Present Value (NPV) framework treats each loan as an investment, helping lenders evaluate profitability alongside default risk. By factoring in loan pricing, cost of risk, and customer acquisition cost (CAC), lenders can optimize decisions for portfolio growth and sustainable profits.

Q: How can lenders improve profitability beyond traditional credit scoring?

A: Beyond credit scores, lenders can leverage holistic decision frameworks that integrate cash-flow insights, dynamic pricing, and CAC optimization. This approach increases approvals, reduces bad loans, and aligns lending strategies with long-term revenue goals.

Q: Why is pricing strategy important in profitable lending?

A: Effective loan pricing balances risk and customer affordability. Real-time and segment-level pricing, combined with innovative product structures, helps lenders attract profitable customers while maintaining competitive interest rates. Dynamic pricing ensures sustainable growth even during economic shifts.

Q: What role does customer acquisition cost (CAC) play in lending profitability?

A: CAC directly impacts the profitability of new borrowers. By leveraging data-driven acquisition strategies, partnerships, and targeted segmentation, lenders can lower CAC, focus on high-value customers, and maximize long-term portfolio returns.

Q: How can lenders operationalize profitable lending strategies today?

A: Modern decision platforms enable lenders to integrate NPV frameworks, automate risk and pricing decisions, and run experiments on different segments. This allows lenders to continuously optimize loans for growth, profitability, and customer lifetime value. Request a demo to explore how Taktile’s AI Decision Platform can lead to profitable growth for lenders.